How to Get Your Finances in Order Before Buying a Home

So, you’re ready to jump into the exciting world of home buying? Whether it’s your first rodeo or you’re coming back for round two, the secret to success is simple: get your finances in tip-top shape. Because let’s face it, buying a house isn’t just about swooning over open-floor plans or picturing

Read MoreInvesting in Real Estate: Where to Begin

So, you’re ready to dip your toes into the world of real estate investing. Congratulations! Whether you’re dreaming of flipping fixer-uppers like a reality TV star or collecting rent checks from a fleet of charming rental properties, the real estate market offers a wealth of opportunities. But wher

Read More

Recent Posts

How to Get Your Finances in Order Before Buying a Home

Pricing Your House Right: Don’t Start Too High or it's All Downhill From There

Navigating the Post-NAR Settlement World: What Agents Need to Know and How to Thrive

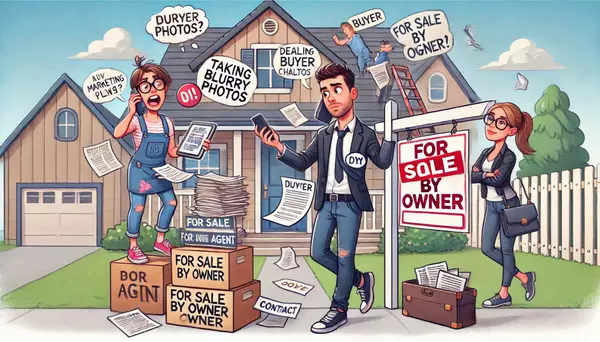

“I’ll Save the Commission and List It Myself” – Famous Last Words of Home Sellers

The Art of Cold Calling: Why Your Ears Are Your Most Valuable Tool

Investing in Real Estate: Where to Begin

Selling High-End Homes with High-End Interest Rates: Strategies to Overcome Today's Market Challenges

The 1031 Exchange: Your Real Estate Superpower

Staging a Home - The Hilarious Art of Pretending You Don't Live Here

Why my house is still for sale...